Rising or falling interest rates can change your EMI, your eligibility, and even your decision to buy now or wait. In 2025, smart buyers are not just watching home loan headlines. They are planning their budgets, comparing lenders, and locking rates at the right time so their total cost of ownership stays in control.

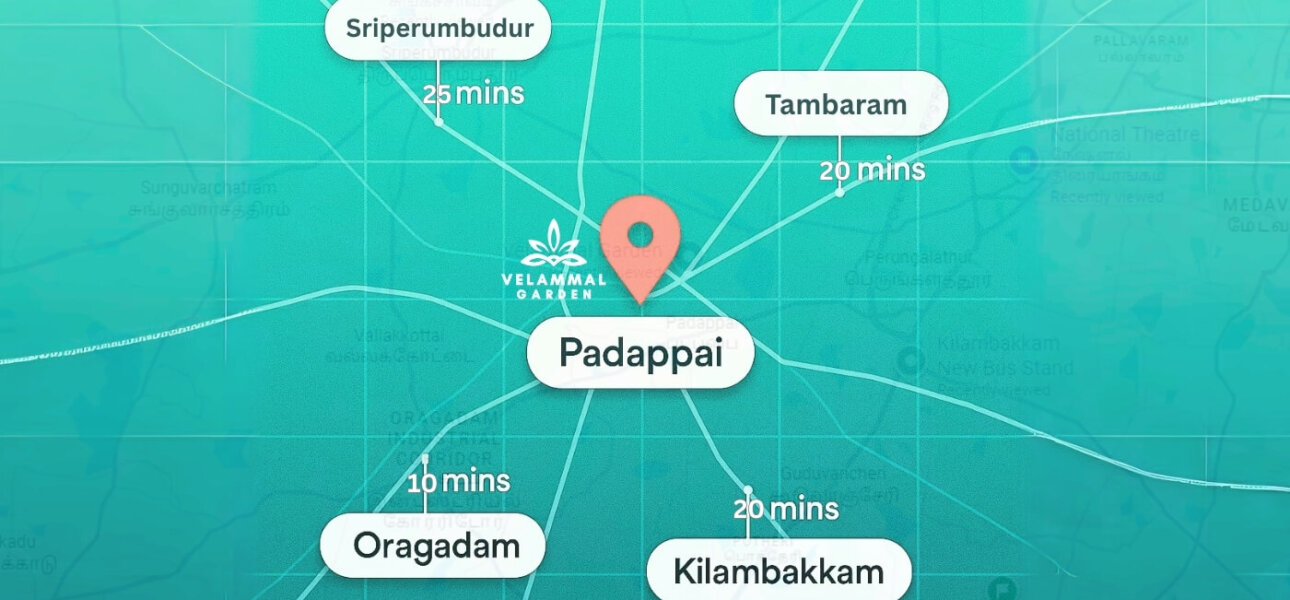

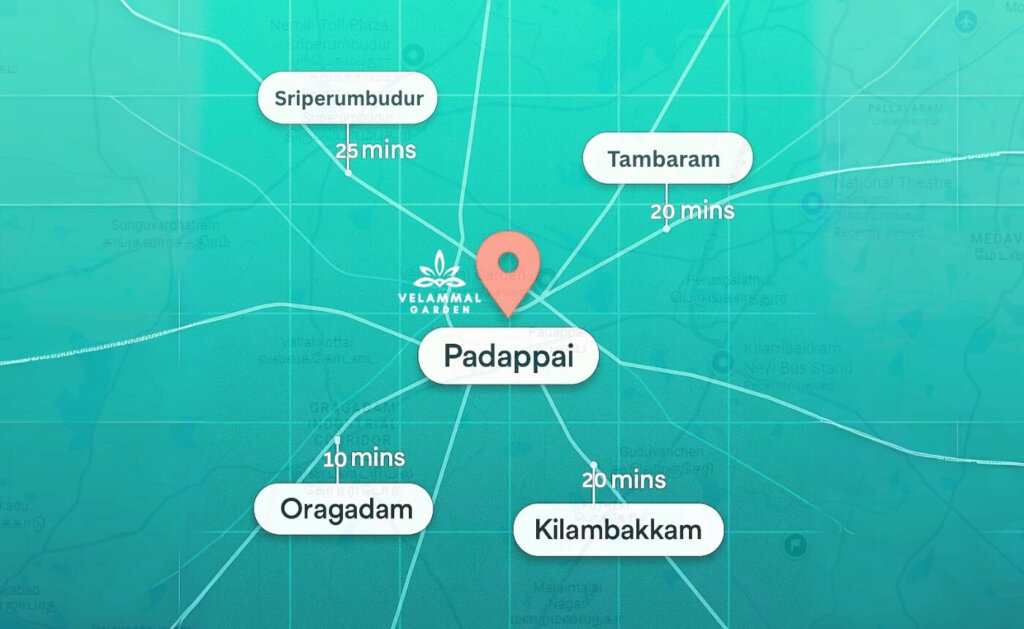

If you are eyeing a DTCP and RERA approved plot at Padappai in the Oragadam belt, understanding rate movements is your edge. Here is a clear, Chennai-focused guide to help you decide with confidence.

What do interest rate trends mean for plot buyers

Interest rates move in cycles. Banks revise their lending rates based on the broader economy and policy signals. For you as a buyer, this affects three things:

• EMI size on a land loan or construction loan

• Total interest outgo over the tenure

• Loan eligibility because of lender affordability checks

When rates are steady or easing, EMIs either hold or reduce. When rates rise, EMIs increase unless you extend tenure. Both have an impact on your overall cost and how soon you become debt-free.

Plot loans vs home loans in Chennai

Many buyers plan a two-step journey at Padappai and Oragadam. First, they take a plot loan to acquire the land. Next, they switch to a construction loan when they are ready to build.

• Plot loan

Usually has a slightly higher rate and a shorter maximum tenure than a ready-home loan. Lenders may ask for a higher down payment and strict documentation on DTCP and RERA approvals, layout plan, and seller KYC.

• Construction loan

Rates can be comparable to home loans once the building plan, estimate, and approvals are in place. Disbursement typically happens in stages as construction progresses.

Tip for buyers near Padappai

Choose a project with clean approvals and a known developer. This reduces processing time, can fetch you better terms, and speeds up sanction. Velammal Garden’s DTCP and RERA compliance is a practical advantage when you present your file to multiple banks.

Fixed vs floating in 2025

• Floating rate

Moves with the market. You benefit if rates soften. You pay more if they rise. Most Indian borrowers opt for floating because prepayment charges are minimal and long-term costs can trend lower across cycles.

• Fixed rate

Gives EMI certainty for a period. Useful if you are highly risk-averse or your monthly cash flow is tight. Fixed offers can reset after a few years, so read the fine print.

Smart approach for 2025

Pick floating for flexibility, but protect yourself with strong prepayment discipline. If you anticipate bonuses or business inflows, a floating loan lets you reduce principal whenever you want.

How much do small rate moves matter

Even a 0.25 percent change can be meaningful over long tenures. Here is an easy thumb rule to remember:

• For every ₹10 lakh of loan over 15 years, a 0.25 percent higher rate can add a few hundred rupees to your monthly EMI and tens of thousands to total interest across the tenure.

• If you prepay early, the impact drops sharply because interest is front-loaded in the first years.

The takeaway

Do not obsess over the perfect bottom. Aim to close on a fair rate, then accelerate prepayments in the first three to five years.

Eligibility and credit score hygiene

Chennai buyers often lose weeks because of small eligibility gaps. Tighten these before you apply:

• Keep your credit utilisation below 30 percent and avoid new unsecured loans three months before application

• Correct errors in your credit report and ensure all addresses match your KYC

• Maintain a stable bank balance for at least three months to reflect down payment and closing costs

• If salaried, keep salary credits consistent. If self-employed, prepare last two to three years’ ITRs, GST returns, and bank statements

Should you buy the plot now and build later

In growth corridors like Padappai and Oragadam, land values are influenced by connectivity, industrial demand, and supply of approved layouts. If your budget is ready but construction will take time, buying the plot first can be sensible:

• You lock today’s price and secure your preferred plot number and facing

• You can convert to a construction loan later or do a top-up, depending on lender policy

• You can keep EMIs manageable by planning staged prepayments

Visit velammalgarden.com to explore available plot sizes and orientations that fit your financing comfort.

Rate-savvy negotiation checklist with lenders

When you approach multiple banks or housing finance companies, use this script:

• Ask for the effective rate for your profile, not the advertised slab

• Request the internal benchmark spread to understand how future resets will apply

• Clarify processing fees, legal and valuation charges, and technical visit fees

• Confirm foreclosure and part-prepayment rules for floating and fixed variants

• Check if there is a lower rate for women co-applicants or salaried profiles

• Get written confirmation on the reset frequency for floating loans

Pro tip

Once you get a first sanction, use it to negotiate a match or beat offer from a competing lender. Even a small cut improves lifetime savings.

EMI structuring for Padappai buyers

EMIs should fit your lifestyle and buffer for rate moves. A simple structure that works well:

• Start with a 15 to 20 year tenure to keep EMIs comfortable

• Automate a fixed monthly prepayment, even if it is just 2 to 5 percent of EMI

• Add windfall prepayments from bonuses or business milestones

• If rates rise, prefer prepayment over tenure extension so you finish sooner

Example workflow

Shortlist your plot in Velammal Garden, block it with a booking amount, apply to two lenders in parallel, and finalise the sanction with the best all-in cost. Align your registration date with disbursement timelines so you do not pay unnecessary interest days.

Local lens: Why Padappai and Oragadam hold steady through cycles

This belt benefits from three anchors:

• Industrial ecosystem

Automotive, electronics, and logistics parks keep demand resilient for residential land.

• Connectivity

Proximity to GST Road, ORR links, and airport access strengthens buyer interest and appraisals.

• Approved layouts

DTCP and RERA compliance increases lender comfort and resale confidence, regardless of short-term rate noise.

Explore current inventory and site-visit slots at velammalgarden.com for transparent pricing and on-ground guidance.

Action plan for 2025 buyers

• Finalise budget with a 10 to 15 percent buffer for registration and initial development works

• Keep down payment ready in a single account, seasoned for at least 60 days

• Get a pre-sanction so you can negotiate the exact plot you want

• Choose floating, commit to prepayments, and review your rate at every reset

• If building within 12 to 18 months, align architect drawings early to switch seamlessly to a construction loan

FAQs

What is the typical down payment for a plot loan in Chennai

Most lenders expect 20 to 30 percent down payment for plot loans. Having 30 percent ready improves negotiation power and speeds up sanction.

Can I convert my plot loan to a construction loan later

Yes. Once your building plan and approvals are ready, lenders can convert or top up to a construction loan. Keep all documents clean and updated to make the switch smooth.

Should I pick a fixed or floating rate in 2025

Floating suits most buyers because you can prepay without heavy penalties and benefit if rates ease. Consider fixed only if your cash flow is extremely tight and you value EMI certainty.

How can I reduce interest cost without waiting for lower rates

Start prepaying from month one. Even small, steady prepayments in the first three to five years can cut your total interest substantially and shorten the tenure.

Does buying in a DTCP and RERA approved layout really help with loans

Yes. Clean approvals reduce legal risk for lenders, often speeding up sanction and sometimes unlocking better terms. Projects like Velammal Garden in Padappai offer documentation that banks recognise readily, which helps buyers close faster.

Ready to run numbers, compare offers, and pick the right plot in Padappai’s fastest-growing belt Visit velammalgarden.com to book a site visit and get bank-friendly paperwork in place from day one.